Planned Giving

BEQUESTS

Bequests are gifts by will—whether in the form of cash, securities or other property—and may be fully deducted in determining federal and state taxes on your estate. Charitable bequests are one of the easiest ways to make a planned gift.

Donors may designate either a percentage of their residuary estates after provisions for survivors or others are fulfilled, a specific sum, or a combination of both. There is no minimum amount for bequests.

The most common types of bequests are:

- Residual bequest, which leaves to MCC all or a portion of the remainder of the estate after specific bequests, taxes, and costs have been paid;

- Percentage bequest, which provides that a stated percentage of a particular asset or of the estate be given to MCC;

- Specific bequest, through which MCC receives particular property outright (for example, certain securities or a specific dollar amount of cash); and

- Contingent bequest, whereby MCC is a beneficiary of part or all of the estate upon the occurrence of certain specified events.

Sample Bequest Language:

The following sample bequest language expresses the concepts above. It is offered simply as a guideline. MCC strongly suggests that you seek expert, professional advice.

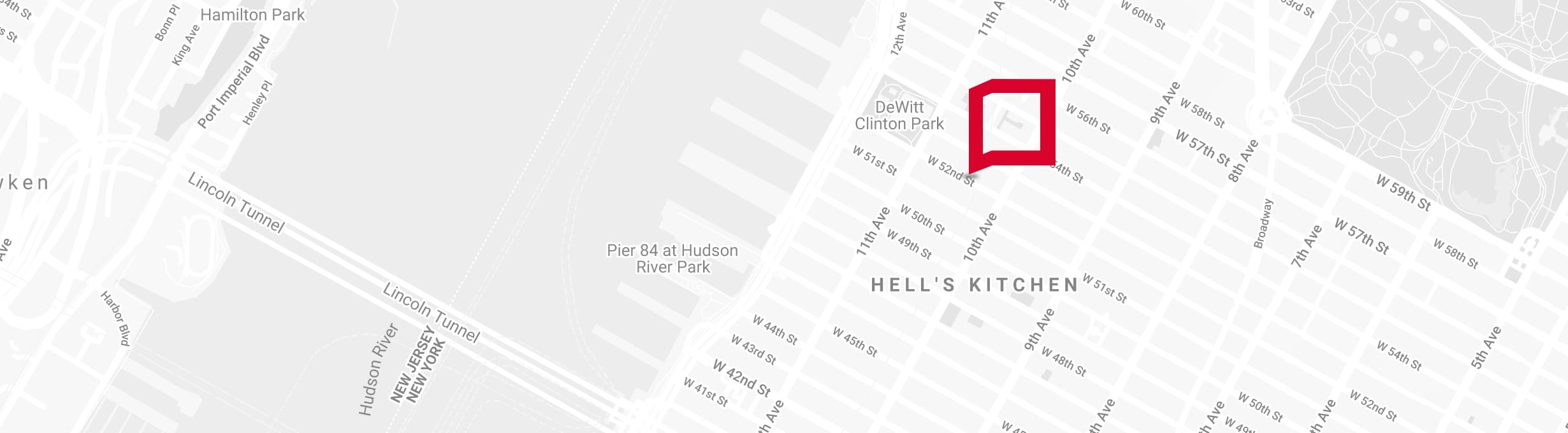

Residual Bequest: “I hereby give, devise, and bequeath to Manhattan Class Company, a New York corporation with its principal offices at 511 West 52nd Street, [all] (or) [____%] of the rest, residue, or remainder of my estate, to be used for its general purposes.”

Percentage Bequest: “I hereby give, devise, and bequeath to Manhattan Class Company, a New York corporation with its principal offices at 511 West 52nd Street, ____% of [__________ (description of asset)] (or) [my estate], to be used for its general purposes.”

Specific Bequest: “I hereby give, devise, and bequeath to Manhattan Class Company, a New York corporation with its principal offices at 511 West 52nd Street, [the sum of ______ dollars ($______)] (or) [__________ (description of property)], to be used for its general purposes.”

Contingent Bequest: “I hereby give, devise, and bequeath to Manhattan Class Company, a New York corporation with its principal offices at 511 West 52nd Street, _______________ [description of property] in the event that ___________________ [description of condition], to be used for its general purposes.”

ACCOUNT BENEFICIARY

Your retirement accounts, life insurance policies, or savings and investment accounts are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

Want access to our full 2023/24 season?

YES!

Click to YES to learn more about all the exclusive benefits for

SUBSCRIBERS & PATRONS

THE ROBERT W. WILSON MCC THEATER SPACE

Our new home in Hell’s Kitchen allows us to deepen our mission and encourage greater collaboration among all of our ARTISTS, STUDENTS, and AUDIENCES.